Extend Credit to a World of New Customers

Nova Credit unlocks cross-border credit bureau data to help businesses underwrite new-to-country newcomer populations, with access to over 1.5 billion credit profiles worldwide.

More Ways to

More Ways to Increase Originations Profitability With Confidence

Nearly 100% of population growth in developed countries is driven by immigration. The newcomer segment presents a better risk profile on average vs. domestic populations.

More Ways to Build Brand Loyalty Through Financial Inclusion

Addressing a consumer segment that’s underserved by financial products and services helps build brand equity over the long term.

More Ways to Improve Risk Assessment for International Arrivals

International credit data translated to a local equivalent format helps lenders assess credit risk for consumers with little to no local credit history.

Credit Passport®

Extend credit to a world of new customers

280 million newcomers worldwide have to abandon credit history that's locked in their home country. Credit Passport® opens access to international consumer-permissioned credit data to help lenders serve this market, building loyal customers for life.

Credit Passport® gives you localised analytics into the creditworthiness of an immigrant applying for financial products like credit cards, loans, device financing, and more. Our solution translates international credit data from ~1.5 billion credit profiles in real time to a standardised credit report.

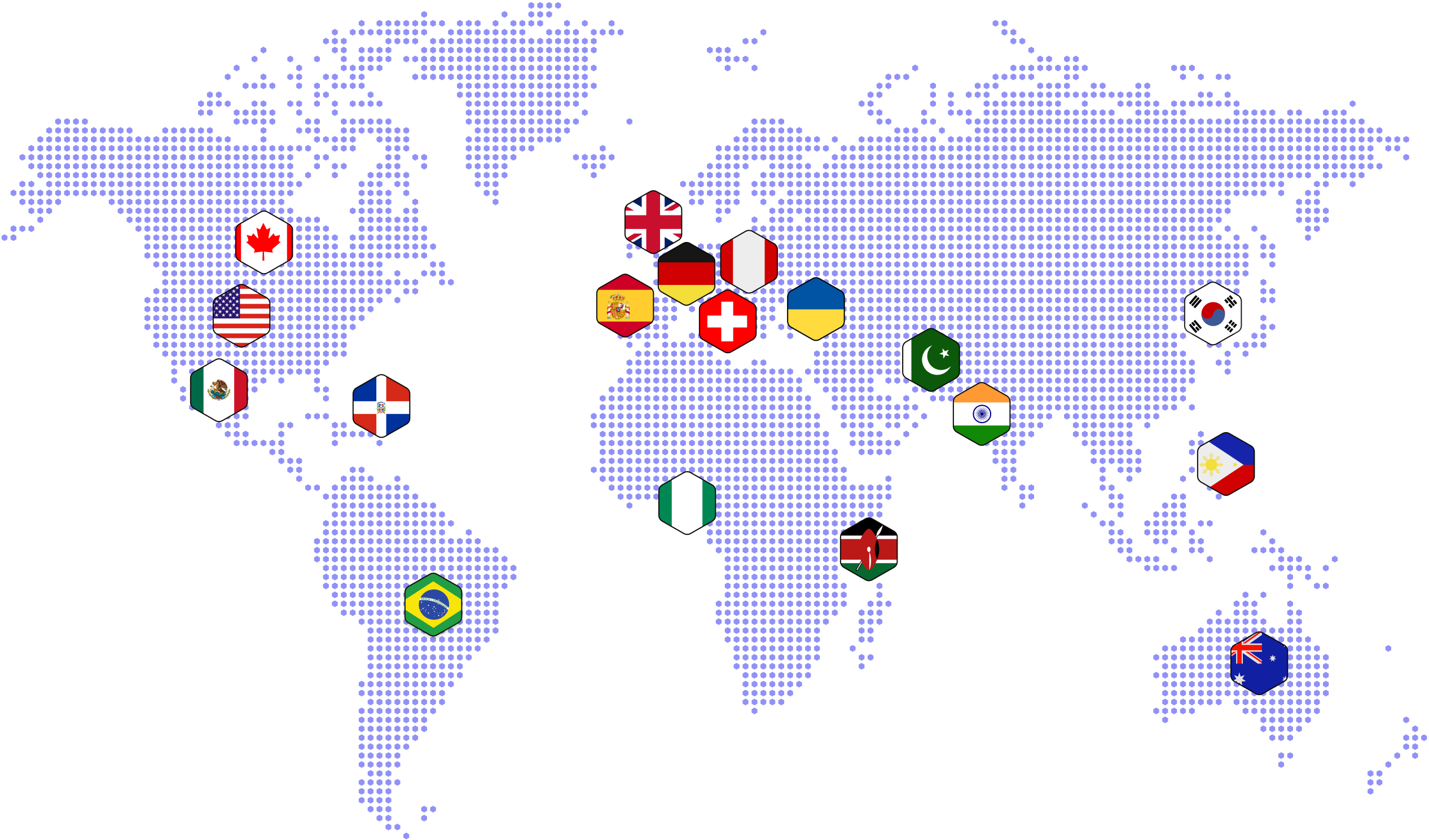

Global Supply Relationships

Our integrations with international credit bureaus enable access to up to 2.8 billion credit records in more than 20 countries. Among our partners:

“Opening up a world of opportunity sits at the core of HSBC’s purpose and we’re always passionate about identifying new ways to solve problems faced by our international customers… Accessing credit in a new market can be a challenge… We're excited to be partnering with Nova Credit to improve our ability to do this even more, with its innovative digital Credit Passport.”

Taylan Turan | Group Head of Retail Banking and Strategy, Wealth and Personal Banking

Why Businesses Choose Nova Credit Canada

7k+

Serving more than seven thousand customers worldwide.

1.5B

Consumer Credit Files

26

Data sources across traditional credit bureau, bank data aggregators, payroll systems, and others.

Expert Analytics & Guidance

Nova Credit Canada is led by a team of experts in credit risk and lending. Our dedicated services team delivers trusted integration services, strategic advice, and ongoing support.

Speed to Implementation

A "one stop shop" to access standardised credit data from all over the world via a single API endpoint.

Purpose-Built for Credit Risk

Our solutions are designed to predict creditworthiness by transforming new trustworthy data sources into proven risk insights.

Partnership announcement

Nova Credit Expands into Canada, Partnering with Scotiabank as First Canada-Based Bank to Serve Newcomers with Global Credit Underwriting

Continued international expansion makes Nova Credit the first consumer-permissioned credit bureau to solve cross-border credit challenges for Canada-bound newcomers

Partnership announcement

Nova Credit announces partnership with Royal Bank of Canada to help create a smoother financial start for newcomers

The Royal Bank of Canada (RBC) is collaborating with Nova Credit to leverage Credit Passport® to deliver a real-time standardized credit history translation for RBC's Global Credit Connect.

Let’s Grow Your Business Together

Submit your information and a member of our team will be in touch about how we can grow your business together.