Cash Atlas™

Lift your Underwriting with Granular Cash Flow Data

Get a leg up over traditional credit data to make more informed decisions on no file, thin file, and even thick file consumers. Cash Atlas™ analyzes bank transaction data to provide you with FCRA-compliant attributes, reports, and scores to build a complete risk profile to assess consumer affordability and ability to pay.

Trusted By:

How Cash Atlas™ Works

Cash Atlas™ helps you generate a complete risk profile for your consumers across the credit spectrum. In a few simple steps, it can categorize and condense bank transaction data into risk attributes with adverse action codes, helping you make more informed approval decisions.

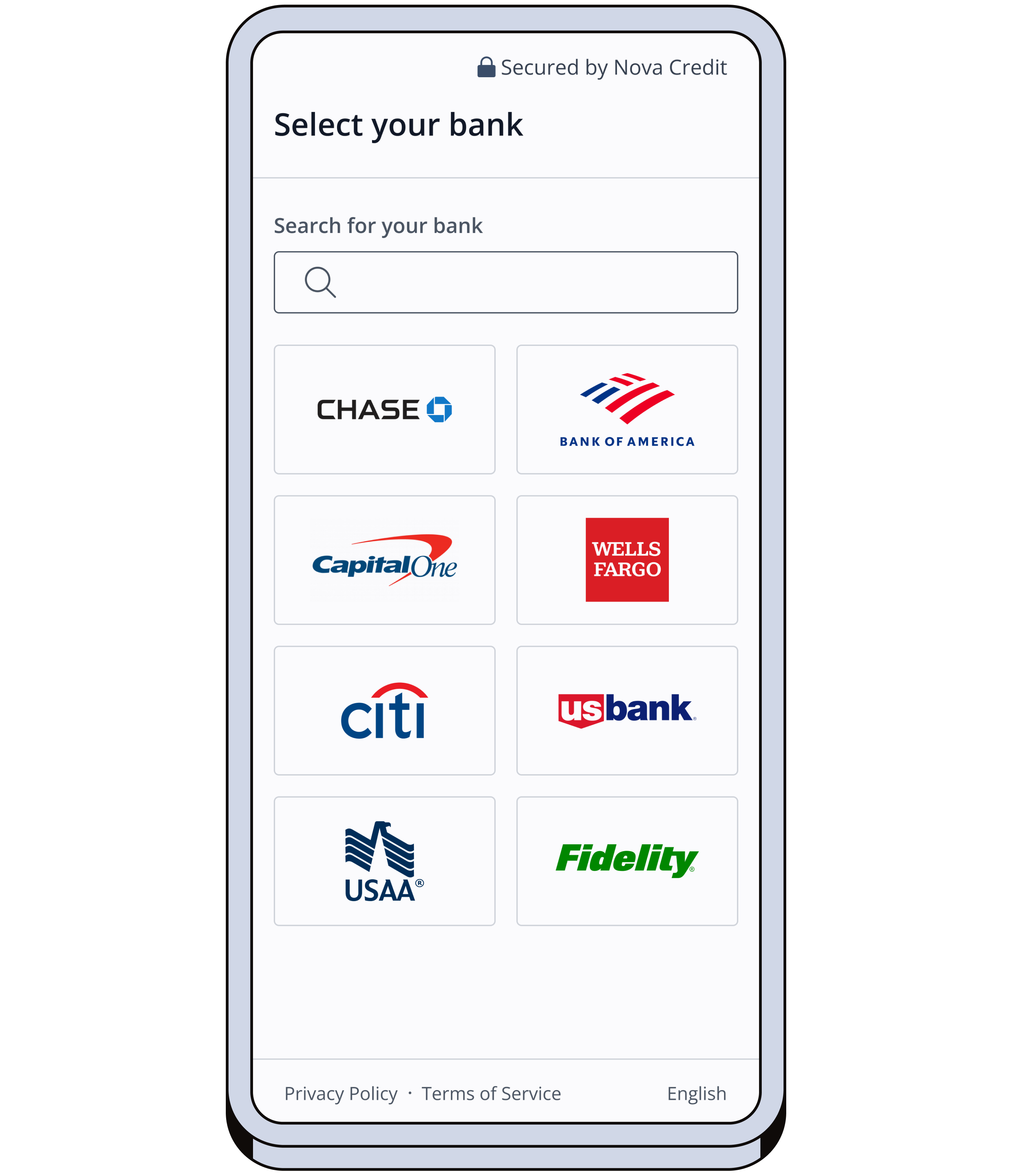

The user authorizes access to their data and selects the account(s) they would like to connect — all from within your digital application journey.

The user’s bank transaction data is retrieved, normalized, and modeled with our 1,000+ performance-tested attributes to meet your underwriting criteria.

Nova Credit delivers real-time insights based on model criteria to help you make better-informed credit decisions about your applicant.

Why Cash Atlas™

Improve risk assessment

Use cash flow data to supplement or stand in for traditional credit history, providing an enhanced view of your consumer’s present and future ability to pay.

Originate more loans

By measuring affordability in conjunction with credit risk, Cash Atlas™ enables unparalleled insight into consumer creditworthiness to expand your market.

Reduce testing cycles and maximize risk prediction

Spend less time building and more time driving customer acquisition using attributes proven to predict credit risk.

A Multi-Industry Solution

Our solutions help financial institutions, property managers, and lenders make smarter decisions and reach more qualified customers with an added layer of insights.

Learn more about our Solutions by Industry and Solutions by Use Case

Credit Cards

Financial institutions can evaluate more consumers to open broader access to credit.

Property Leasing

Property managers can identify reliable tenants using cash flow data in combination with traditional credit information, allowing them to fill vacancies faster while maintaining strong risk standards.

Auto & Personal Loans

Lenders can underwrite more consumers without increasing default rates while offering more competitive terms to qualified applicants based on their complete financial picture.

Buy Now Pay Later

BNPL platforms can reduce their default rate by improving the risk assessment of applicants

Connect Instantly to Consumer-Permissioned Cash Flow Data

Get easy access to consumer-permissioned bank transaction data through our best-in-class module. With Nova Credit’s coverage of over 95% of financial accounts, consumers can grant you access directly within your digital application.

Cleaned, Processed, and Normalized Bank Data

Nova Credit’s proprietary approach improves the signal-to-noise ratio of bank transaction data, helping to erase traditional roadblocks, including:

Differentiating between real income and non-income related inflows (e.g. transfers, merchandise returns, etc.)

Identifying money movement between accounts owned by the same individual

Differentiating between individual and joint accounts; reporting on both the consumer and account levels

Attributes Proven to Predict Risk

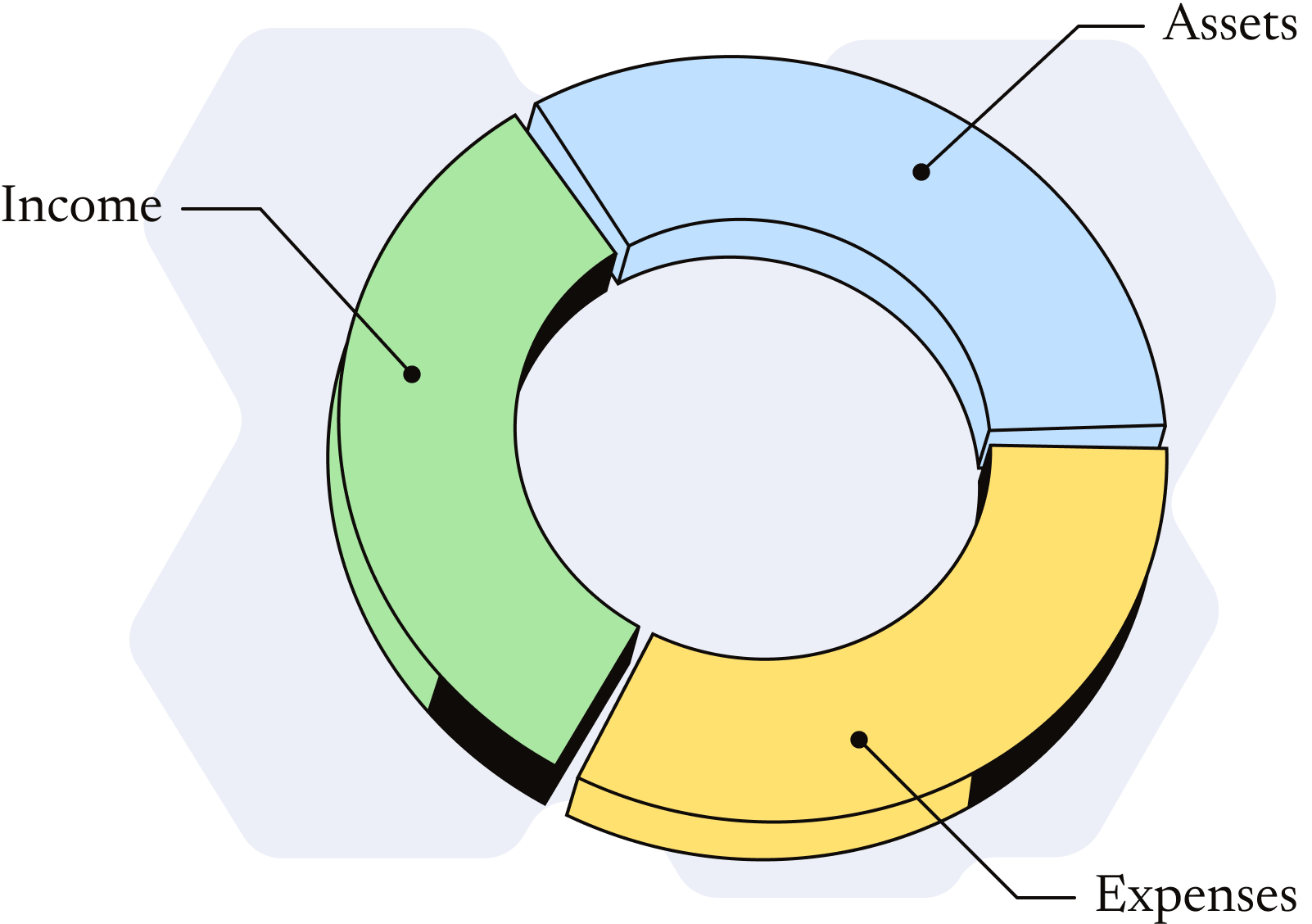

Reduce the engineering resources you devote to quantifying risk separation using our suite of over 1,000 attributes, each performance-tested against actual risk data to ensure predictive power. These attributes, representing behaviors over a single day to 24-month timeline, are built for underwriting, and include adverse action language and special value handling. Each line item is classified as one of three major data types — income, assets, and expenses — then aggregated into attributes for use in your decisioning and pricing strategies.

NovaScore Cash Flow (NSCF): A powerful risk score built on bank data

NSCF enables lenders to make credit decisions with a more comprehensive view of applicants' financial health. Whether used alone or in conjunction with traditional credit scores or models, NSCF delivers significant boost in predictive performance.

Cash Flow Underwriting: A Practical Credit Risk Implementation Guide for Lenders

Learn how to turn cash flow data into your competitive advantage

Get the practical implementation framework top lenders use to boost approvals by 15% while maintaining risk profiles. This expert guide delivers ready-to-use strategies backed by real-world success stories from innovative credit leaders.

Let’s Grow Your Business Together

Submit your information and a member of our team will be in touch. about how we can grow your business together.