Welcome to the Nova Credit Blog

Unlock the Power to Underwrite Anyone

Explore how we're transforming credit, income, and cash flow decisioning for institutions worldwide.

Articles by Category

Most Popular Articles

Building the Credit Bureau of the Future: Reflections on Our Series D

At Nova Credit, our mission is to create a better financial system—one where every consumer has fair access to the financial products they need, and every business can grow responsibly using comprehensive financial data.

Nova Credit Cash Flow Solutions to be Utilized by Chase

Nova Credit's platform and advanced analytics to enhance Chase underwriting capabilities

Nova Credit Redefines Credit Data Onboarding and Underwriting with Launch of the Nova Credit Platform

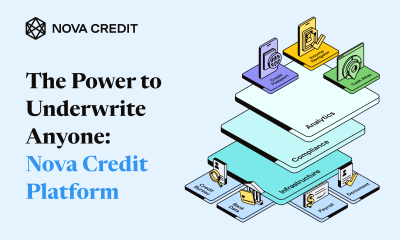

Platform capabilities include multi-source data orchestration, embedded analytics across Nova Credit’s three flagship products, flexible deployment, and end-to-end compliance framework.

Seen Finance™ Partners with Nova Credit to Expand Credit Access by Leveraging Cash Flow Data

Strategic partnership brings cash flow data solutions into seamless workflows to bring better credit offers to consumers

Case Study: How Atlanticus Unlocked 15% More Approvals While Maintaining Risk Standards

Leading subprime credit card program leverages cash flow data to responsibly expand credit access

Nova Credit Honored in Built In's 2026 Best Places To Work Awards

Nova Credit earns placements on Built In's Best Places To Work List for both San Francisco and New York for the second consecutive year

Nova Credit Redefines Income and Asset Verification in Affordable Housing with Launch of Eligibility Compass

New product delivers income and asset verification in minutes, not weeks

Nova Credit Raises $35M Series D to Accelerate Cash Flow Underwriting Revolution

Socium Ventures led the funding round expected to drive expansion of the industry-leading Nova Credit Platform as demand for real-time financial data and analytics surges

Nova Credit Announces Eugene Ludwig, Former U.S. Comptroller of the Currency and Managing Partner at Canapi Ventures, Joins Board of Directors

Banking industry veteran brings decades of regulatory expertise and fintech investment experience to advance Nova Credit's mission of inclusive financial services

PayPal Selects Nova Credit to Power U.S. Cash Flow Underwriting

PayPal partners with Nova Credit to expand consumer credit access by incorporating cash flow insights into underwriting

Socure and Nova Credit Partner to Expand Credit Access Through Cash Flow Insights

New integration enables lenders to responsibly approve more qualified borrowers through Socure's RiskOS™ decisioning platform

Scotiabank leads with first-in-Canada digital integration of Nova Credit for newcomers

New digital onboarding and Nova Credit integration offers newcomers a convenient head start.

Nova Credit Named to CNBC's World's Top Fintech Companies 2025

Nova Credit selected for the prestigious list for a second year running.

Nova Credit Announces Second Annual Cash Flow Underwriting Summit to Convene Industry Leaders that are Accelerating the Adoption of Cash Flow Underwriting

Building on the success of last year’s inaugural Summit, the forum brings together leaders from nearly all top 40 U.S. consumer lenders to unlock the power of cash flow underwriting.

Imprint Partners with Nova Credit to Enhance Underwriting with Cash Flow Analytics

Leading co-branded credit card provider integrates Cash Atlas™ through Alloy platform to expand consumer access and improve risk decisions

Yardi Embeds Nova Credit's Cash Atlas™ to Broaden Approvals for Credit-Invisible Applicants

Industry-leading collaboration brings cash flow underwriting to 6+ million rental units, opening more doors for 49 million excluded applicants

Nova Credit Partners with MRI Software to Combat Rental Fraud and Enhance Income Verification

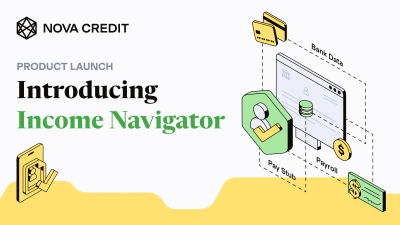

MRI Software integrates Nova Credit's Income Navigator for multi-source verification, boosting fraud prevention and application screening while cutting processing times and covering nearly 100% of applicants.

Nova Credit Expands Collaboration with Yardi to Combat AI-Driven Document Fraud in Rental Applications

Yardi's integration with Nova Credit's fraud detection technology shields property managers from AI-generated document fraud. This solution defends against convincing falsified documents that could cause significant financial losses in property management.

Nova Credit and Entrata Partner to Enhance International Tenant Screening

Nova Credit's integration with Entrata gives property managers access to international credit histories, solving a key challenge for newcomers.

4 Essential Insights for Lenders Exploring Cash Flow Underwriting

Discover how cash flow underwriting is revolutionizing lending by analyzing real-time financial behavior, helping institutions expand credit access while reducing risks and costs—essential knowledge for lenders in today's evolving financial landscape.

3 Key Takeaways from the Cash Flow Underwriting Implementation Guide

Tim Bates' detailed report offers financial institutions a strategic framework for implementing cash flow underwriting, highlighting multi-dimensional insights, optimal use cases, and implementation approaches.

Nova Credit Named to Forbes Best Startup Employers List for Fourth Consecutive Year

Recognition highlights Nova Credit's commitment to employee satisfaction, workplace culture and company growth.

Nova Credit Featured in Forbes Fintech 50, Highlighting Success with Cash Flow Underwriting

Nova Credit returns to Forbes Fintech 50 in 2025, showcasing its evolution from immigrant-focused credit solution to comprehensive platform serving major institutions through innovative cash flow underwriting and data analytics.

Nova Credit Announces Advanced Document Fraud Detection for Income Navigator

As document tampering becomes increasingly sophisticated, our enhanced capabilities help businesses identify falsified income verification documents with greater accuracy.

Key Insights: Building a Data Access & Analytics Strategy

In a recent webinar, experts from PayPal and Nova Credit shared critical insights on operationalizing cash flow underwriting in the open banking era

Built In Honors Nova Credit in Its Esteemed 2025 Best Places To Work Awards

Nova Credit earns placements on Built In’s Best Places To Work List for both San Francisco and New York

Nova Credit Named Fintech of the Year: Transforming Credit Access Through Innovation

Nova Credit, the credit infrastructure and analytics company that enables businesses to grow responsibly by harnessing alternative credit data, has been named "Fintech of the Year" by This Week in Fintech.

The Fraud-Fighting Power of Modern Income Documentation Verification

Organizations face a critical challenge: How can they verify income accurately while protecting against sophisticated fraud schemes? Fight fraud through modern income verification

Nova Credit Named One of North America's Fastest-Growing Companies in the 2024 Deloitte Technology Fast 500™

Nova Credit's 591% revenue growth is driven by widespread adoption by major institutions like American Express, HSBC, and SoFi, coupled with continued expansion into U.K. and Canadian markets.

Open Banking in the U.S. Will Create Many Winners, Specifically Consumers

The newly issued CFPB Rule 1033 will make open banking a necessity for financial institutions, giving consumers more control over their financial data and expanding inclusion into the financial system

HSBC UK to Make International Mortgage Applications Easier for Applicants Utilising International Credit History

HSBC UK is the first major bank to launch an initiative allowing international mortgage applicants to retrieve their credit history for a UK mortgage application

Nova Credit and SoFi Expand Multi-Year Relationship with Cash Flow Underwriting Capabilities

Nova Credit’s consumer-permissioned data and analytics solution, Cash Atlas, will be leveraged by SoFi to bolster loan underwriting

Quarters and Nova Credit Partner to Empower Canadian Newcomers with Credit Access and Accelerated Home Savings

This collaboration offers newcomers to Canada the opportunity to build and transfer credit history, easing their transition and helping secure housing faster.

Scotiabank Expands Partnership with Nova Credit to Enhance Digital Credit Access for Newcomers Across Canada

Expansion will enable cross-border credit checks on Scotiabank’s web and mobile applications for newcomers with foreign credit history.

3 Key Takeaways from the Inaugural Cash Flow Underwriting Summit

The Cash Flow Underwriting Summit in downtown New York drew over 200 of the brightest minds in consumer credit to discuss the state and future of cash flow underwriting.

MoneyLion Partners with Nova Credit to Activate Cash Flow Underwriting Within its Consumer Finance Ecosystem

Partnership enables lenders on the MoneyLion platform to use Nova Credit’s cash flow underwriting data and analytics, expanding consumer access to credit

Nova Credit and Akoya Announce Partnership to Enable Access to Cash Flow and Income Analytics

Akoya and Nova Credit partner to help lenders deploy cash flow income analytics to improve credit decisioning through increased data access

BMO Helps Newcomers Make Real Financial Progress Through Nova Credit Partnership

New strategic partnership enables newcomers from nine countries to access their credit history to make their financial transition in Canada faster, easier and more inclusive.

Rogers Welcomes Newcomers with International Credit Recognition

New partnership with Nova Credit makes transition to Canada easier. Newcomers can finance a new smartphone and build credit in Canada.

Nova Credit Appoints Nichole Mustard, Credit Karma Co-founder and Former Chief Revenue Officer, to its Board of Directors

Nichole Mustard joins Nova Credit's Board of Directors to enable responsible business growth and insights by harnessing the power of consumer credit data.

Nova Credit Awarded to the CNBC World’s Top FinTech Companies 2024 List

Nova Credit, the leading credit infrastructure and analytics company, has been ranked in the World’s Top FinTech Companies 2024 by CNBC.

Nova Credit announces partnership with Royal Bank of Canada to help create a smoother financial start for newcomers

The Royal Bank of Canada (RBC) is collaborating with Nova Credit to leverage Credit Passport® to deliver a real-time standardized credit history translation for RBC's Global Credit Connect.

New Partnership with Nottingham Building Society unlocks door to mortgage finance for UK newcomers

Nova Credit’s second UK partnership provides one of the country’s top 10 building societies with access to foreign credit histories to get more mortgage finance into the hands of skilled and professional new-to-country UK applicants.

Introducing the NovaScore Cash Flow: the Future of Consumer Credit Risk Scores

Analyzing cash flows from income, expenses, debit transactions, and financial behaviors, the NovaScore Cash Flow provides statistically significant lift in multiple use cases and across all credit tiers

3 Key Observations on the Evolution of Credit Risk Analytics in the Age of Alternative Data

Nova Credit's Senior Director of Data Science, Suna Hafizogullari, shares her recent observations on the changing role of global credit data, the importance of alternative data in credit and lending, and the future of credit risk analytics.

New Research Finds 90% of Lenders See Alternative Data as Key to Approve More Worthy Borrowers

Findings indicate significant acceleration in the use of new data sources - beyond traditional credit reports - that will expand financial opportunities for over 100 million U.S. consumers

New Partnership with SingleKey Increases Housing Accessibility for Canadian Newcomers

The partnership provides property managers access to foreign credit histories, helping Canadians new to the country to get approved for their new home faster and more accurately

The Power to Underwrite Anyone: Introducing the Nova Credit Platform

The Nova Credit Platform is a significant development in Nova Credit's ability to give lenders the power to underwrite anyone. Yes, anyone. Read Misha Esipov's comments on the launch to understand how and why we are powering a more fair financial system.

Nova Credit Honored in Fast Company’s Most Innovative Companies 2024

Nova Credit, the leading credit infrastructure and analytics company, has been selected as the #9 Most Innovative Company in Finance 2024 by Fast Company.

Nova Credit Named to Forbes - America's Best Startup Employers 2024

Nova Credit, the leading credit infrastructure and analytics company, has been named to the Forbes - America's Best Startup Employers list for the third consecutive year.

Nova Credit Named to Great Place to Work® List for 2024

Nova Credit, the leading credit infrastructure and analytics company, announced that it has been certified as a Great Place to Work® for the third consecutive year.

Nova Credit Partners with SafeRent Solutions, Further Expanding Income Navigator Solution in the Property Management Sector

SafeRent will leverage Nova Credit’s Income Navigator to automate income verifications with near 100% applicant coverage.

Partnering with AppFolio to Automate Income Verification and Reduce Fraud Risk for Property Managers

The partnership expands Income Navigator, Nova Credit’s verification of income solution, in the tenant screening industry, improving conversion rates for consumers and property managers.

Introducing ‘Income Navigator,’ a New Leader in Income Verification Coverage, Flexibility, and Compliance

Nova Credit bolsters its product offering to help more companies automate verification of income, significantly improving coverage, conversion and user experience.

Nova Credit Named to 2024 Fintech Innovation 50 List

For the second year in a row, Nova Credit was named to the Fintech Innovation 50, an annual list launched by GGV Capital U.S. to recognize the most promising fintech companies in the eyes of startup investors.

Nova Credit and Creditinfo Bridge Cross-Border Credit Access for Ukrainians

Credit Passport® solution eases financial challenges for migrants by connecting U.S., U.K., Canadian and other international lenders to translated credit data from Creditinfo’s IBCH Ukraine

Main Takeaways: Cash Flow is Here: Top use cases helping underwriters today

Join a panel of industry experts as they dive into cash flow underwriting’s practical use cases & access the entire webinar on demand.

Nova Credit Appoints Financial Industry Veteran as Chief Customer Officer Alongside Leadership Promotions to Accelerate Cash Flow Underwriting

Momentum signals enhanced C-suite as fintech doubles-down on cash flow underwriting and verification solutions ahead of open banking adoption in the U.S.

Nova Credit Raises $45M Series C Financing to Scale Cash Flow Underwriting and Verification Solutions Across the Credit Industry

Global adoption of the fintech’s cross-border credit solution leads to expansion of product suite, building end-to-end infrastructure and analytics for lenders to better leverage alternative credit data

HSBC UK partners with Nova Credit to become first UK bank to offer newcomers option to include international credit history when applying for a credit card

Newcomers to the UK can now leverage their international credit history instantly and free of charge when applying for a credit card with HSBC UK, thanks to a new partnership between the bank and Nova Credit, the world's only cross-border credit bureau.

New UK Market Study Highlights Importance of Cross-Border Credit Solution for Newcomers

Lenders That Level the Playing Field for UK Immigrants Will Benefit Most From One of UK’s Fastest-Growing Demographics

Nova Credit Expands into Canada, Partnering with Scotiabank as First Canada-Based Bank to Serve Newcomers with Global Credit Underwriting

Continued international expansion makes Nova Credit the first consumer-permissioned credit bureau to solve cross-border credit challenges for Canada-bound newcomers

Earnest and Nova Credit Launch International Private Student Loans

New Partnership Expands Access to Higher Education for International Students in the United States

HSBC and Nova Credit Launch Partnership to Offer Customers Borderless International Credit Checking

Following a successful deployment in Singapore, HSBC Ventures invests in Nova Credit to further accelerate the roll-out of Credit Passport® worldwide

Supporting diversity, equity and inclusion at Nova Credit

Today, we are publicly sharing our team’s commitments to advance an inclusive workplace and fintech industry.

Autonomy and Nova Credit Launch Partnership to Expand Access to Electric Vehicles

This first-of-its-kind partnership will expand access to electric vehicle subscriptions by enabling automated credit risk decisioning for Autonomy customers with ‘thin file’ or no credit report history

Nova Credit Honored in Built In’s Esteemed 2022 Best Places To Work Awards

Nova Credit Ranks on NYC’s List of Best Small Companies to Work For and Best Paying Companies

Nova Credit Partners with HUGS to Help Students Access Housing in Competitive California Market

Nova Credit, the world’s leading consumer-permissioned credit bureau, today announced a partnership with HUGS, the San Diego-based startup that’s defining the future of student housing.

Nova Credit Partners with Alloy to Help Lenders Serve Consumers Across the Credit Spectrum

Alloy integrates Nova Credit’s products into their credit underwriting solution

Nova Credit Named a Best Place to Work in Fintech by American Banker; Best Workplace in Bay Area by Fortune

Continued string of accolades also includes Best Contribution to Economic Mobility in Banking/Finance by Fintech Futures and inclusion in Startup Search’s 2022 Fintech List

Nova Credit partners with Westlake Financial to help recent immigrants get access to auto loans

Nova Credit delivers first and only global credit data to Westlake, unlocking auto financing options for immigrants to the U.S.

Nova Credit Named Among the World’s Most Innovative Companies by Fast Company

Company also recognized by Forbes in America’s Best Startup Employers 2022 list

Nova Credit Hires Former Apple, Meta Engineering Leader as Head of Engineering

Yacine Azmi joins to scale product engineering efforts and grow the engineering organization

Nova Credit and SafeRent Solutions Partner to Increase Housing Opportunities for Immigrants

Innovative Approach Reduces Business Risk While Increasing Opportunity for Newcomers to Access Housing by Tapping Into International Credit History

Nova Credit Introduces Cash Atlas™ – A Cash Flow Underwriting Solution That Allows Businesses to Lend More Responsibly Using Bank Transaction Data

The fintech’s newest product supports financial inclusivity by using alternative data to assess consumers’ ability to pay, both now and in the future.

Nova Credit and Prodigy Finance Partner to Assist U.S.-Bound Students Gain Access to Student Loans

Nova Credit delivers global credit data to Prodigy Finance, unlocking education financing options for students studying in the U.S.

Nova Credit and Vesti Partner to Alleviate Financial Barriers for U.S.-Bound Nigerians

This Partnership will enable Nigerians to leverage their home country credit profile when applying for a Vesti Card upon arrival to the U.S.

Nova Credit Named to Inc. 5000 List of Fastest-Growing Private Companies in the U.S.

Fintech ranks #521 overall and #41 within the financial services group

Nova Credit Named to Inaugural Embedded Fintech 50 List

Nova Credit, the world’s leading consumer-permissioned credit bureau, was named to the Embedded Fintech 50, a list launched by GGV Capital in partnership with Crunchbase, to recognize the most promising fintech companies in the eyes of startup investors.

Nova Credit Named to Great Place to Work® List for Second Consecutive Year

Nova Credit, the world’s leading consumer-permissioned credit bureau, today announced that it has been certified as a Great Place to Work® for the second consecutive year.

Nova Credit Named to Forbes List of America’s Best Startup Employers 2023 For Second Consecutive Year

Verizon, in partnership with Nova Credit, provides newcomers to the country access to the best 5G

Through this unique partnership, Verizon makes it easier for people that are new to the U.S. to get the best financing on the latest devices

Nova Credit looks to expand into Europe, seeking to unlock credit for immigrants excluded from archaic cross-border credit system

Nova Credit has announced the company’s planned expansion into Europe. The company will focus initially on the UK with the ambition to serve the whole European market.

Nova Credit and Verizon Expand Partnership

Consumer-permissioned credit bureau enables newcomers to utilize their credit history from certain countries to get device financing in-store

Nova Credit Appoints Chief Revenue Officer and Vice President of International Amidst Hiring Momentum and Revenue Growth

Company increases revenue by five-times in 2021 resulting in notable team expansion

Six Reasons to Leverage Cash Flow Data

Hear why a former chief risk officer, Brian Hughes, of Discover thinks credit bureaus don’t provide enough risk data that lenders need in today’s environment, and what alternative solutions exist.

Is the Lending Industry Ready for Alternative Data?

From 2008-2023: How Recessionary Periods Put a Spotlight on Credit Scores

Al Etihad Credit Bureau (AECB) Accelerates Cross-Border Credit Access in Collaboration with Nova Credit

AECB has announced a strategic collaboration with Nova Credit to enable newcomers to leverage their home country credit history when applying for financial services upon arrival to the UAE.

Nova Credit Receives Authorisation to Become UK’s First Cross-Border Credit Reference Provider

Nova Credit UK, a wholly owned subsidiary of Nova Credit, has received the requisite scope of permissions in order to provide credit references in the UK from the Financial Conduct Authority (FCA).

Research Finds Majority of Lenders Now Use Alternative Data in Underwriting Process

Movement beyond credit bureau reports comes at a critical time to support lenders as they navigate a tumultuous landscape and seek growth opportunities without taking on more risk

Top takeaways: The Evolving Landscape of Cash Flow Underwriting Webinar with Mission Lane

Two data science consultants discuss the changing landscape of cash flow underwriting and detail how lenders are in a unique position to quickly implement and launch the solution.

Measuring the Impact of the End of Student Loan Forbearance

Former chief risk officer, Brian Hughes, offers cash flow underwriting as a solution to help lenders calculate the impact of the end of student loan forbearance.

Nova Credit introduces the next chapter of underwriting with bank data to better assess risk and serve consumers across the credit spectrum

Cash Atlas™ is a consumer-permissioned, FCRA consumer report that enables lenders to better serve consumers across the credit spectrum using bank transaction data.

Accelerating the Inevitable with Consumer-Permissioned Data

Today, we are formally (and finally!) announcing our biggest product launch since our founding. It’s a broadening of our vision to modernize the credit system. Let me tell you why.

Evaluating Alternatives to Credit-Based Underwriting

Learn why cash flow data not only enhances lender capacity to accurately assess consumer credit risk, but has the potential to end the idea of a credit excluded population.

The Case for Cash: A Whitepaper for Inclusive Lending

Including the Credit Excluded

Top 3 takeaways from the LendIt webinar on banking data, featuring Nova Credit, Experian, and Prosper

Sarah Davies, Chief Risk & Analytics Officer at Nova Credit, joined leaders from Experian and Prosper Marketplace on a webinar discussion to discuss a unique solution that connects high consumer scalability with high predictive risk accuracy.

The Impact of Financial Services Access on Immigrants: A Nova Credit Research Report

Nova Credit, sought to better understand the challenges and opportunities that newcomers face when it comes to accessing financial and related services in the U.S. It surveyed 300 immigrants who have arrived since 2016.

Nova Credit Income Verification Helps Yardi Enhance Resident Screening

Yardi becomes the first company to leverage both of Nova Credit’s financial inclusion-focused products: Credit Passport® and Income Verification

Nova Credit enables SoFi to verify customer income through bank transaction data and expand financial access to the informal economy

Nova Credit enables SoFi to verify customer income through bank transaction data and expand financial access to the informal economy

Celebrating International Migrants Day

As the world observes International Migrants Day this year, we recognize the 272 million migrants who have made their homes in new communities, bringing new perspectives, creativity, community, and innovation.

Nova Credit taps Salt Edge to enhance access to finance for newcomers to the US via open banking

We've teamed up with Salt Edge, leader in developing open banking solutions, to get instant access to the banking data of newcomers from the UK and EU.

#CelebrateImmigrants with Nova Credit this June and beyond

As the United States celebrates Immigrant Heritage Month this June, we’re recognizing the many ways immigrants contribute to America’s economy and society and re-affirming our commitment to advocate on behalf of our immigrant employees and customers;

Celebrating Asian-Pacific American Heritage Month at Nova Credit

We're highlighting and sharing the stories of some inspiring Asian-American Novans who are helping us build a world beyond borders.

Nova Credit is #EachforEqual

Our company is committed to building the best team in the world. To find the best, we want to recruit from 100% of the population to build a company that sets the standard for the future.

Why we raised a $50M Series B

We’re thrilled to share that we just raised a $50M round led by Kleiner Perkins to finally make the global consumer credit reporting system whole.

Nova Credit expands to Africa through new partnership with CRC Nigeria

Today, Nova Credit is pleased to announce that we’ve partnered with CRC Credit Bureau in Nigeria to allow Nigerians relocating to the U.S. to use their international credit history to apply for credit products.

Why you, the client, should want to be on Version 3 of Nova Credit’s API

Nova Credit pushes significant upgrades to the Credit Passport®

An immigrant's perspective: What unites us is why we are still here

Damira, our beloved Privacy Counsel, through a personal story of her family’s refugee journey reflects on why tackling immigration issues is more important than ever before.

Trump’s State of The Union Address: A denunciation against immigrants

As a company that holds almost as many passports as people, we continue to be saddened by how deeply the animus runs in the highest levels of American politics against people like us or our customers.

Earning ISO 27001 Certification and SOC 2 Type 2 Compliance

Nova Credit has successfully completed its SOC 2 Type 2 Audit and achieved the ISO 27001 Certification covering our Information Security Management System (ISMS).

Former VantageScore executive joins Nova Credit to build a global credit score

Sarah Davies has joined our growing team at Nova as Head of Risk & Analytics. Sarah joins Nova after 12 years with industry leader VantageScore, where she led their risk and analytics function.

Nova Credit will help immigrants from Latin America bring their credit history with them

Nova Credit will begin serving immigrants from South America through partnering with the Brazilian credit bureau Serasa Experian and the Peruvian credit bureau Círculo de Crédito!

Why we stand for immigration

A reflection on the recent developments in U.S. immigrant policy. What does it mean to be American?

International tenant screening for Intellirent's customer base

As a U.S. immigrant without domestic credit history, renting an apartment can be hard. This is why we partnered with Intellirent.

Let’s Grow Your Business Together

Submit your information and a member of our team will be in touch. about how we can grow your business together.