Case Study: How Atlanticus Unlocked 15% More Approvals While Maintaining Risk Standards

Leading subprime credit card program leverages cash flow data to responsibly expand credit access

The Challenge: Traditional Bureau Data Misses Creditworthy Subprime Consumers

Atlanticus, an Atlanta-based fintech that enables bank partners to offer more inclusive financial services to everyday Americans, faced a familiar challenge in the subprime lending space: traditional credit bureau data often fails to capture the complete financial picture of their target customers.

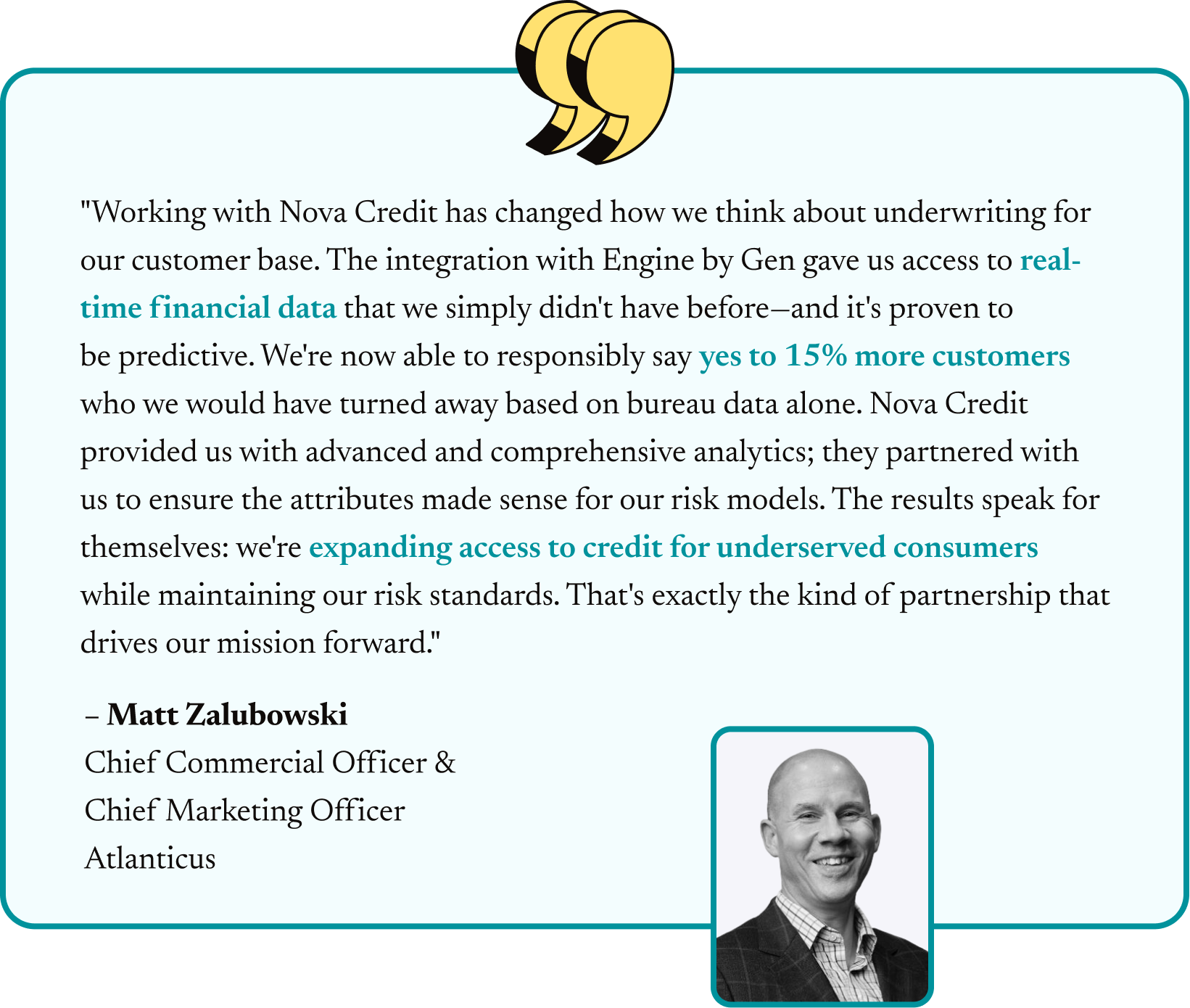

"Our audience has always been savvy about their financial needs," explains Matt Zalubowski, Chief Commercial Officer and Chief Marketing Officer at Atlanticus. "They're credit hungry, but they're also thoughtful about where to go and what they're willing to share. The question for us was: how do we get better at assessing risk for this population?"

Operating multiple credit card brands through their bank partners, Atlanticus serves consumers who are often overlooked by prime lenders. With credit cards representing their largest business segment, every approval decision matters—both for responsible growth and for helping consumers access the credit they need. Atlanticus needed a scalable solution to responsibly expand their addressable market.

The Solution: Cash Flow Data That Reveals True Financial Capacity

Atlanticus partnered with Nova Credit to deploy Cash Atlas, accessing consumer-permissioned bank transaction data through embedded finance platforms like Engine by Gen. This multi-channel approach aligned with Atlanticus's strategy of meeting consumers where they are, while maintaining consistent risk definitions across channels.

"We look at cash flow data in two ways," says Zalubowski. "Does it get you in the door? And does it maybe get you a better seat once you're inside?" For Atlanticus, this translated to both expanding their addressable population and optimizing terms for approved customers.

The implementation focused on information that provides meaningful risk differentiation. Rather than replacing their existing models, they integrated cash flow attributes as powerful additional variables in their multivariate decisioning approach.

15% Approval Lift With Risk Confidence

The partnership delivered measurable results that exceeded expectations. Atlanticus found that 15% of marginal declines—consumers they would have rejected based on traditional bureau data alone—could be profitably approved using cash flow insights. These weren't incremental gains on borderline cases; these were meaningful approvals for consumers who demonstrated strong financial capacity through their bank transaction data, even when their credit files told an incomplete story.

What made these results particularly compelling was that performance aligned perfectly with risk expectations, showing no deterioration in credit quality. The cash flow data enabled more aggressive lending by revealing creditworthy consumers who had been invisible to traditional underwriting models. Beyond the approval lift, Atlanticus also gained the ability to optimize line sizes and pricing for approved customers, moving beyond simple yes-or-no decisions to more nuanced credit offerings.

From a technical standpoint, the validation was equally strong. All top-performing cash flow attributes aligned with proven subprime risk indicators that Atlanticus's experienced risk team already understood and trusted. The integration with existing underwriting infrastructure was seamless, requiring no wholesale replacement of existing models or processes. This gave the risk team confidence in the sustainability and scalability of the approach.

The strategic value extended beyond the immediate performance metrics. By accessing cash flow data through embedded finance platforms like Engine by Gen, Atlanticus created a competitive advantage in serving high-intent consumers with better conversion rates. The foundation they built for cash flow analytics can now be expanded across other acquisition channels, multiplying the impact of the initial implementation.

The Broader Impact: Transforming Subprime Underwriting

The Atlanticus partnership demonstrates how cash flow data addresses fundamental challenges in subprime lending. Traditional credit reports often miss the nuanced financial behaviors of consumers who manage money differently—those who may not have extensive credit history but demonstrate consistent income and responsible cash management.

"When we see someone with steady direct deposits every two weeks—that's a huge risk splitter for us," notes Zalubowski. "We went from essentially no information to really useful information that helps us make better decisions."

This approach proves particularly valuable during periods of economic uncertainty, when traditional bureau data struggles to provide a real-time snapshot of a consumer's financial situation.

The integration with embedded finance platforms, Engine by Gen, proved especially powerful, streamlining the consumer consent process and delivering high-intent applicants who were ready to share their financial data for better outcomes. Amanda Noodell, VP, Partner Solutions at Engine by Gen emphasizes the collaborative nature of the success: "Our partnership with Nova Credit and Atlanticus shows how powerful it can be when the right partners come together around a shared mission. By integrating Cash Atlas into the customer journey, we're helping our customers get approved for credit they deserve but might not have qualified for through traditional channels. The results speak for themselves—higher approval rates, better terms, and more satisfied customers."

Looking Forward: The Future of Inclusive Credit

For Atlanticus, cash flow underwriting represents more than just an approval lift—it's a pathway to serving their mission of providing prime-like solutions for underbanked Americans.

"Our longer-term goal is to act on this data across use cases as it becomes influential and informs all of our modeling," explains Zalubowski. "It's not just a one flag—it becomes something that we can look for additional trends and deeper insights that help us better serve our customers—across product lines and in ongoing customer management."

The partnership positions Atlanticus to capitalize on the broader industry shift toward real-time financial data, regulatory developments like CFPB Rule 1033, and changing consumer expectations around data sharing for better financial outcomes.

As Atlanticus continues to scale through strategic acquisitions and market expansion, cash flow underwriting through Nova Credit's Cash Atlas provides the foundation for responsible growth—helping more Americans access the credit they need on terms they can afford.

Ready to Take the First Step?

For Lenders

Discover how Cash Atlas can help you responsibly expand credit access while maintaining risk standards.

About Nova Credit

Nova Credit is a credit infrastructure and analytics company that helps lenders make smarter decisions using alternative credit data. Through its FCRA-compliant platform, Nova Credit transforms fragmented consumer financial data into actionable risk analytics that increase conversion through expanded coverage, speed, and reliability. The company serves over 7,000 businesses including HSBC, SoFi, Scotiabank, Appfolio, and Yardi with solutions like Cash Atlas™ for cash flow underwriting, Income Navigator for income verification, Eligibility Compass for income and asset verification, and Credit Passport® for new-to-country consumers.

About Atlanticus

Atlanticus is an Atlanta-based financial technology company that provides credit and related financial services to underbanked consumers. Through brands including Aspire, Imagine, and Fortiva, Atlanticus serves consumers often overlooked by traditional prime lenders.

About Engine by Gen

Engine by Gen, the category-leading embedded finance marketplace platform, matches consumers with real-time, personalized financial product recommendations from the largest connected network of top providers—on mobile apps, websites, and other consumer touchpoints.

Engine by Gen serves as the B2B brand of Gen (NASDAQ: GEN). Learn more at: www.engine.tech.

About Gen

Gen (NASDAQ: GEN) is a global company dedicated to powering Digital Freedom through its trusted consumer brands including Norton, Avast, LifeLock, MoneyLion and more. Gen brings award-winning products and services in cybersecurity, online privacy, identity protection and financial wellness to nearly 500 million users in more than 150 countries. Learn more at: www.GenDigital.com.