Tenant Screening

Automate workflows and reduce fraud with wide-coverage income verification

Accelerate approvals, reduce tedious tasks, and avoid fraudulent renters with our customizable, end-to-end income verification solution, Income Navigator.

Partners have seen conversion rates improve up to 80% over previous solutions by leveraging our waterfall with bank, payroll, and pay stub data.

Trusted By:

How Income Navigator Works

Create a true picture of income with broad coverage bank data, payroll systems, and pay stub data. Leverage an efficient and accurate process to confirm an applicant’s income in seconds.

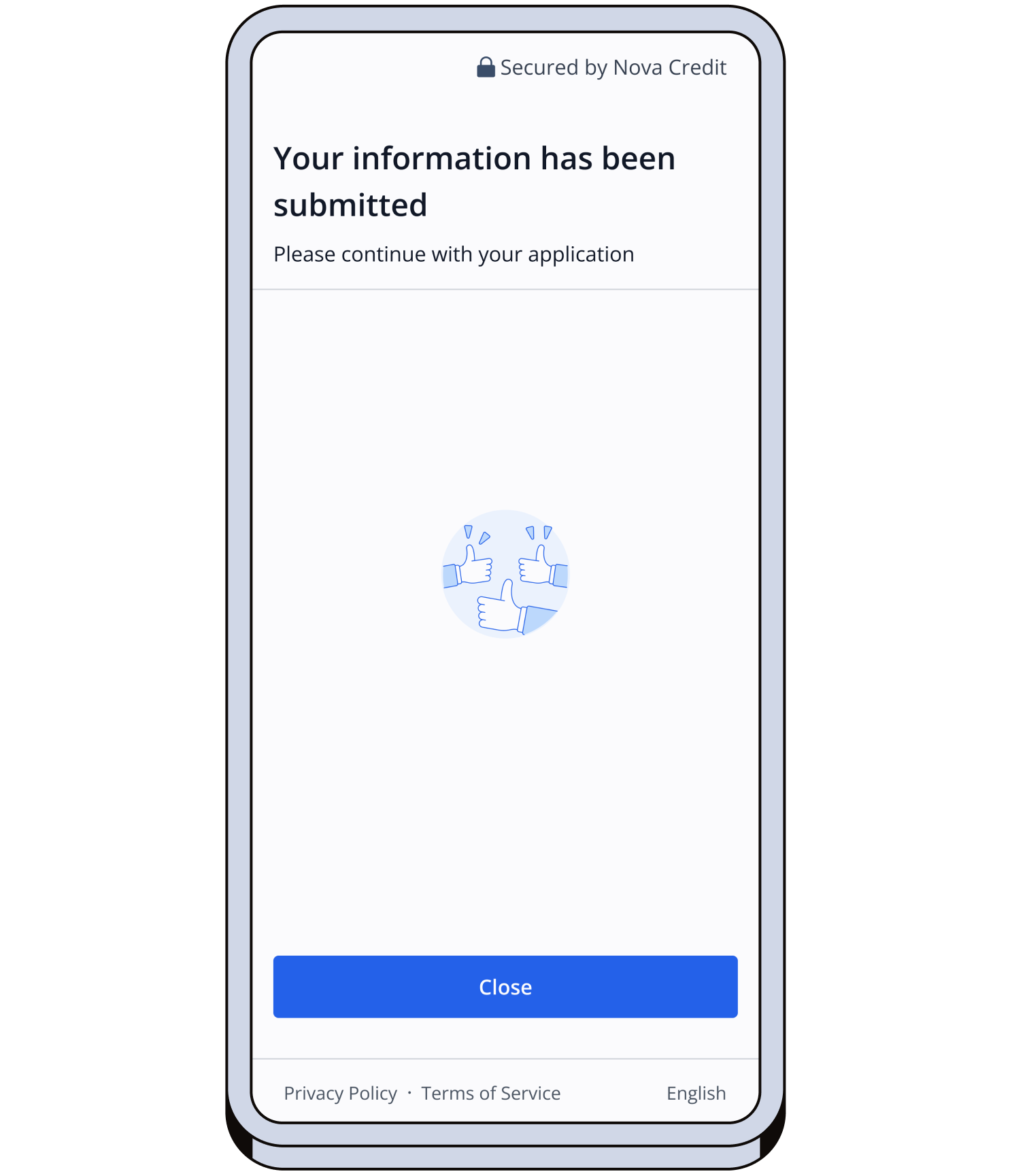

Nova Credit automatically triggers a waterfall process to verify the applicant’s income through multiple sources. User journeys are highly adaptable to maximize conversion rates.

Applicants will be guided to connect one or multiple bank account(s), and can choose to upload a pay stub if they are unable to connect a bank account. Pay stubs are automatically reviewed for fraudulent activity.

Nova Credit delivers income verification data directly via API so you can make informed decisions instantly.

Why Income Navigator for Tenant Screening

Increase conversions by up to 80%

Income Navigator's waterfall provides broad coverage with 98%+ of the U.S. market, leveraging bank data, payroll systems, and pay stub data.

Improve unit turnover time

Screen applicants faster with customized workflows and with more certainty to stabilize rental income streams.

Reduce risk of fraudulent renters

Access income data straight from the source, scan documents for fraud, and automate the internal review processes for better income reporting.

How we're different

Multiple Ways to Collect Income Data

All-in-one solution to collect bank, payroll, and pay stub data through multiple data aggregators or manual document upload.

Fraud-resistant Data

Use seasoned data collected directly from banking institutions (or payroll for income) to reduce risk of fraud.

Income Model

Get a true picture of income with multiple income types, including traditional, gig economy, and alternative income.

Customer Operations and Dispute Management

Leverage full-service customer management for data related disputes, currently executed for global banks.

Customized Workflows

Create customized consumer experiences using embedded and no-code options and retrieve processed data through role-based dashboard access or an API integration.

Consumer Reporting Agency (CRA) Compliance

Nova Credit operates as a consumer reporting agency, built with multi-national regulatory frameworks in mind to support large enterprise needs.

By The Numbers

98%

Broadest Coverage: 98%+ of the U.S. market, leveraging bank data, payroll systems, and pay stub data.

4k+

Widespread adoption: over 4,000 customers use our Income Navigator solution.

80%

Conversion lift: Partners have increased conversion rate by a factor of 80%.

Nova Credit’s income verification tool has delivered excellent, tangible results for our business — higher loan conversion, a shorter time to fund, and ultimately a great member experience because the process is so seamless.”

Ratinder Bedi | Chief Credit Officer, SoFi

Leveraging FinTech Platforms for Stronger Tenant Screening Solutions

Learn how Yardi is simplifying the income verification process for property managers and automating verifications.

High-performing verification of income automation has come a long way in the last year. Organizations can now use alternative data to augment traditional verification processes and drive more intelligent, accurate, and inclusive decisions.

Let’s Grow Your Business Together

Submit your information and a member of our team will be in touch about how we can grow your business together.