Advertiser Disclosure

The card offers that appear on this site are from companies from which Nova Credit receives compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). Nova Credit does not include all card companies or all card offers available in the marketplace.

How to apply for an American Express Card with your foreign credit history

Moving to the U.S. used to mean that you need to build credit from scratch in order to apply for credit cards. Using Nova Credit, you can now use foreign credit history to apply for American Express cards in the U.S.

Nova Credit is a cross-border credit bureau that allows newcomers to apply for U.S. credit cards, phone plans, and loans using their foreign credit history.

American Express is a Nova Credit advertiser. This content is not provided by American Express. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and have not been reviewed, approved or otherwise endorsed by American Express.

If you’ve recently moved to the U.S., getting a credit card is an important first step in establishing your new financial life here.

Even if you’re not in the habit of using it to make purchases, managing a credit card is a great way to start building a U.S. credit history. You will need a good credit history in the U.S. to accomplish basic tasks like getting an apartment lease or applying for a mortgage, yet your foreign credit history has historically stopped at the border. Until now.

Fortunately, you can now apply for any American Express Personal Card using your foreign credit history from supported countries. This list includes Australia, Brazil, Canada, Dominican Republic, India, Kenya, Mexico, Nigeria, the Philippines, South Korea, Switzerland, and the U.K.

In this article, we’ll walk you through how to use your international credit history as part of the American Express application process—it’s quick, easy, and free for you as the applicant!

Determine your needs

Before applying for a new American Express Personal Card, think about your top priorities for your card.

Are you focused on earning rewards such as miles and cash back on purchases, or would you prefer a card with minimal fees? Cards with higher reward programs often charge higher annual fees, which can be worth the cost if you value the rewards involved.

What kinds of purchases will you be making with your card and will those purchases help you earn the rewards you’d like? American Express has several Personal Cards that meet various needs. You can explore different options by reading Featured American Express Cards for U.S. Newcomers.

Make sure to carefully review the card terms, benefits, and fees before applying for a card.

Over 100,000 recent newcomers trust Nova Credit

Subscribe to our newsletter for the latest tips and information on setting up life in the U.S.

Complete your online application

Visit the Nova Credit card shop to explore cards that we recommend for newcomers. Once you’ve selected the card you like, click the "Apply Now" button, and fill out the application form on the American Express website.

Two important things to keep in mind before you begin your application:

1. Confirm that you have a good or excellent credit score in your home country: Your credit score could affect your chances of approval of an American Express card. If you have had a credit card or loan in your home country, you likely have a credit history. If you made on-time payments on those accounts, you may have a good credit score.

2. Confirm that you can prove your U.S. residential address: This is typically done via a U.S. bank account statement, phone bill, or utility bill. This is not an exhaustive list of documents required to complete your application, but American Express will likely ask for one of these documents to validate your residential address.

When you begin your application, American Express will ask you for information including your name, email address, date of birth, phone number, address, and an estimate of your annual income.

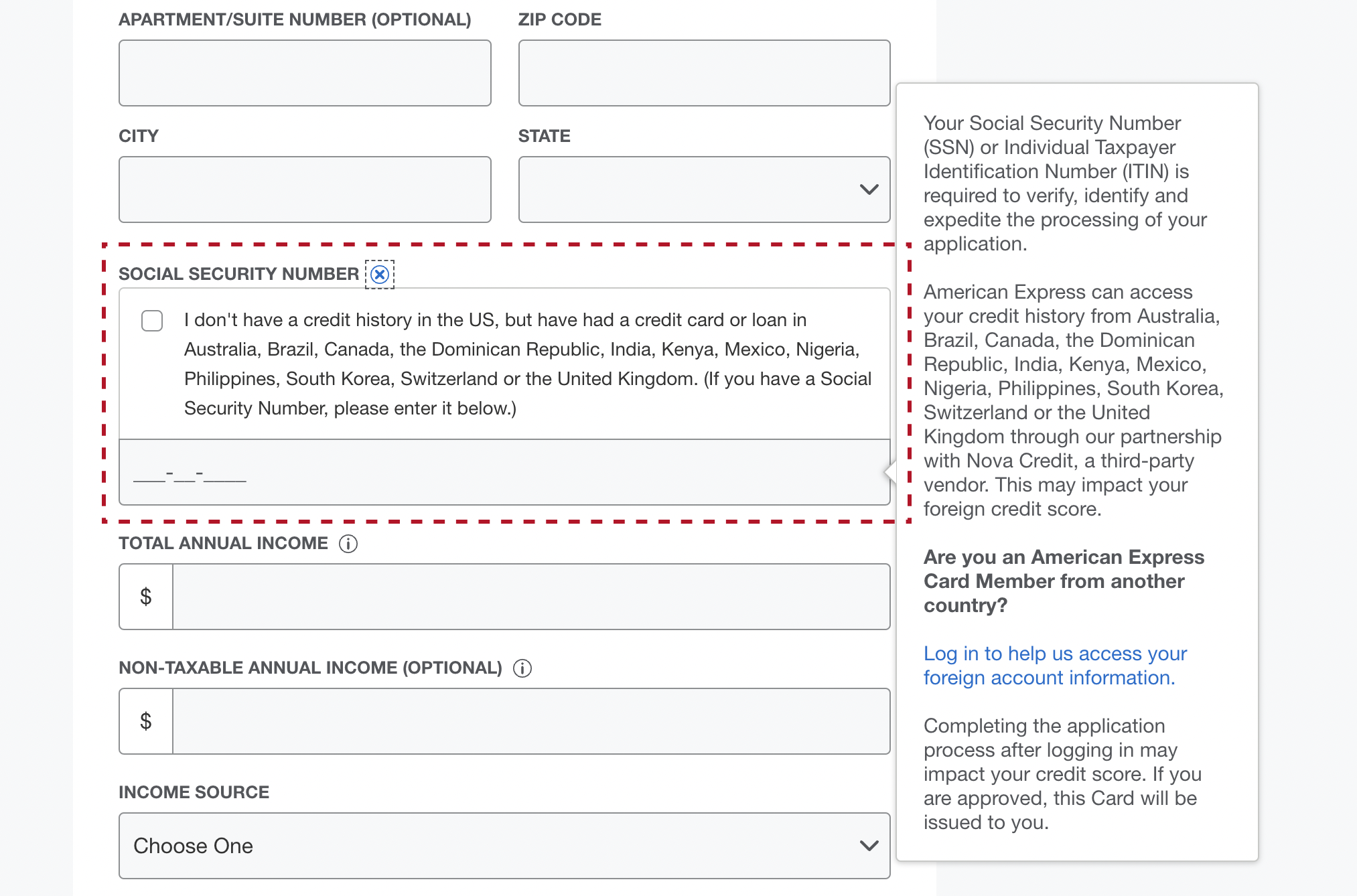

If you have recently moved from one of the supported countries, make sure to check the box above where you’ve entered your SSN (or your ITIN, if you do not have an SSN) that says “I have had a credit card or loan in Australia, Brazil…”

If you do not have sufficient U.S. credit history, this may prompt American Express to ask you to use your foreign credit history later in the application. You can learn more about the application process in our guide.

Note: you must have an SSN or an ITIN to apply for an American Express Personal Card.

Find and share your foreign credit history

Interacting with Nova Credit’s technology is simple. Later in the American Express application, you will be directed to NovaConnect, an interface with your home country credit bureau, where you can find, access, and share your foreign credit report directly with the lender.

Using NovaConnect, Nova Credit will search for your home country credit file through our partnerships with credit bureaus in those countries. If your information is successfully found and authenticated by Nova Credit, we will share it with American Express with your consent.

American Express will then evaluate your foreign credit data as part of your application. If you are approved, you typically will receive a decision instantly. In some cases, your application may be marked as pending until you’re able to share more information.

If you don't qualify for the card of your choice, consider exploring other American Express Personal Card options. The best way to address questions about your status is to speak to an American Express representative.

Applicants who are instantly approved will receive their card numbers digitally. A physical card will come in the mail within 7 to 10 business days. For some cards like the American Express Platinum Card®, however, you can request expedited shipping to shorten the delivery time.

Explore applying for other products with your foreign credit history

Once you’ve gotten your first credit card, use Nova Credit to apply for other essential products in the U.S. Nova Credit helps newcomers apply for phone plans and device financing plans through Verizon, student loans, auto loans, and more with their foreign credit history—no U.S. credit history required!

Currently, Nova Credit serves individuals coming from Australia, Brazil, Canada, Dominican Republic, India, Kenya, Mexico, Nigeria, Philippines, South Korea, Spain, Switzerland, and the U.K.

You can use your foreign credit history from eligible countries to apply for an American Express ® Personal Card in the U.S.