What is an EB-5 Visa?

The Employment Based-5 (EB-5) visa is a type of immigrant visa available to individuals who invest $800,000 in a US company or commercial enterprise based in a targeted employment area (TEA) or $1,050,000 in other areas.

After satisfying certain criteria, the applicants receive permanent residency through a conditional green card, and five years later, they have the option to apply for U.S. citizenship. The visa holder’s spouse and any children under 21 years old at the time of filing are also eligible for permanent residency and eventual citizenship.

Some caveats are attached to the application process itself besides the minimum amount needed for eligibility. Most notably, the investment must be made in a company created after 1990, and must create and preserve 10 full-time employment opportunities for U.S. workers. The lawful source of the funds must be documented, and the capital must be invested “at risk.” per USCIS guidelines.

How does the EB-5 differ from other visas?

Two of the most common non-immigrant visa options for the United States are the F-1 student visa and the H-1B employer-sponsored work visa. These visas are dependent on studying at a specific school or working with a specific company, and come with their own unique requirements.

Let’s dive into how the EB-5 differs from these common visas as a path to study or work in the United States, in order to better understand if the EB-5 may be a fit for your needs.

How the EB-5 Differs From the F-1 Visa

The F-1 student visa provides several restrictions for what an international can do during their time in the U.S. For example, a student’s work hours are limited to 20 per week during the academic year under the Curricular Practical Training program. F-1 visa students also cannot access many scholarships and grants from U.S. institutions, because they are considered international students.

In contrast, EB-5/green card students are not considered international students. This makes them eligible for the same opportunities as U.S.-born students, such as paying lower in-state tuition fees for public colleges and universities. This has the potential to save families tens of thousands of dollars per year.

How the EB-5 Differs From the H-1B Visa

The H-1B visa is a work visa for people with specialty occupations. Unlike the EB-5 visa, it requires the applicant to be sponsored for employment. Since there are fees and administrative work to sponsor foreign nationals, candidates who seek an H-1B visa may find it more difficult to land job offers or even initial interviews from U.S.-based employers.

H1-B visas are also very selective, since at least five times as many individuals apply for H-1B visas than are available (with a yearly cap on visas issued of 85,000). This means that the success of your application hinges on the H1-B lottery system.

Lastly, the H1-B visa is a non-immigrant visa, meaning it does not permit you to live and work in the U.S. permanently. A recipient can be on an H-1B visa for decades—but once their employment is terminated, they need to leave the country within 60 days unless they find another employer. While visa holders can apply to transition from an H1-B to a green card, this change of status is not guaranteed.

Over 100,000 recent newcomers trust Nova Credit

Subscribe to our newsletter for the latest tips and information on setting up life in the U.S.

How to apply for an EB-5 Visa

If you have the financial resources and personal circumstances to apply for the EB-5 visa, follow these step-by-step instructions on how to apply:

Submit Form 1-526

The EB-5 application begins by submitting Form I-526, which must demonstrate that the applicant and their investment have met the criteria set forth by USCIS. If the applicant is in the United States with a current valid visa, they can submit an adjustment of status to receive employment and travel authorization while waiting for the EB-5 petition to be adjudicated.

Receive a conditional green card

After the I-526 is approved, the applicant receives a conditional green card valid for two years. Ninety (90) days before this green card is due to expire, the applicant must file Form I-829 to remove the conditions from the green card, proving that their investment has created and maintained 10 full-time jobs, and that their invested capital was kept “at risk.”

File Form I-829 for permanent green card

Upon approval of the I-829 petition, the applicant and their dependents are granted permanent green cards, giving them up to 10 years before they need to renew them.

Investors do not need to apply for citizenship. If they choose to, they become eligible four years and nine months after their initial conditional green card was granted.

EB-5 quotas and timelines

Each year, the U.S. Department of State grants approximately 10,000 EB-5 visas to investors. The number, however, is not an exact cap, since visas can roll over from one year to the next. For example, in 2022, 10,885 EB-5 visas were made available because of the pandemic-era dip.

The COVID-19 pandemic also affected the time it takes to receive documents. Wait times for conditional green cards have quadrupled, taking anywhere from 47 to 71 months. On the plus side, USCIS has been working through its backlog since the pandemic.

It can be stressful to tie up such a large sum of capital into a process that takes years, even with all the benefits that the visa will provide. With that in mind, some firms, like LCR Capital Partners, allow their clients to split the whole $800,000 sum into two parts. This eases the upfront financial burden and provides extra time to find accruing funds.

The process can also vary depending on the applicant’s country of birth. The 10,000 EB-5 visas available per year are divided by country, with an initial cap of 7% for applicants born in any single country. If a country has more applicants approved than the visas allocated to it, processing is held up until a visa is available.

EB-5 visa cost

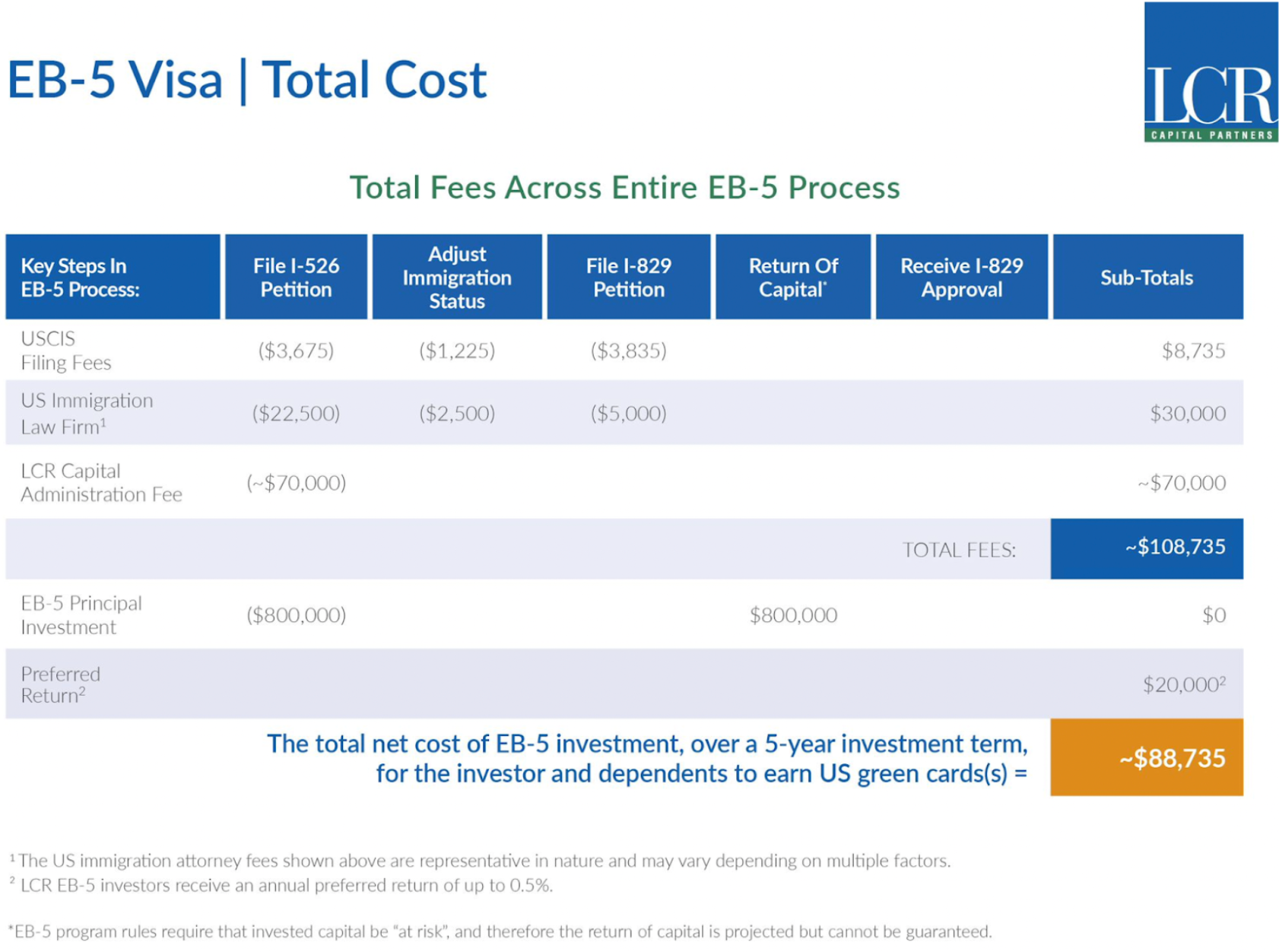

Beyond the $800,000 investment, an applicant is responsible for a number of additional expenses such as immigration attorney fees, an administrative fee for the selected EB-5 project/business that will receive the investment, and the cost of document processing.

Our partner LCR Capital Partners has outlined an estimated total cost in the table below:

The takeaway

The EB-5 visa is a great path to live and work in the U.S.—if you have the financial resources to invest in a U.S. business that meets its criteria. Unlike non-immigrant visas like the F-1 and H1-B, it guarantees visa holders and their family members permanent residency in the U.S. and does not have restrictive quotas or limited duration.

While the process of applying for and obtaining an EB-5 may seem daunting, this guide is intended to help simplify the process of starting your new life in the U.S. Once you’ve gone through these steps and secured your visa, you will have a lot of other life logistics to figure out.

After you have moved to the U.S., you may be able to use Nova Credit to use your foreign credit history from certain countries to apply for great credit cards, phone plans, and more products using your hard-earned credit history from back home—rather than needing to start from scratch as you build a U.S. credit history.

Currently, Nova Credit serves individuals coming from Australia, Brazil, Canada, Dominican Republic, India, Kenya, Mexico, Nigeria, the Philippines, South Korea, Spain, Switzerland, and the U.K.

Use your foreign credit history to start your U.S credit history

New to the U.S.? Check if you can use your country's credit history in the U.S. to apply for credit cards and start your U.S credit history using Nova Credit.

More from Nova Credit

The Ultimate Guide to the EB-2 Visa

The different types of U.S. work visas

The ultimate guide to the F-1 visa

The ultimate guide to the H-1B visa

How to check your USCIS case status

How to build credit after moving to the US

How to get a social security card